In 2026, the global digital finance industry is growing faster than ever, and online money exchange platforms are becoming a core part of modern financial ecosystems. Entrepreneurs, fintech startups, and exchange businesses are now shifting from manual currency exchange systems to advanced money exchanger software that can handle multiple currencies automatically and semi-automatically. Choosing the best money exchanger software is no longer a technical decision alone; it is a strategic business move that determines security, scalability, automation level, user trust, and long-term profitability.

With hundreds of scripts available online, many of which look similar on the surface, making the right choice requires deep understanding, research, and clarity of business goals. A professional money exchanger script should not only support popular digital currencies but also offer seamless automation, flexible admin control, strong security, and a smooth user experience. In 2026, users expect instant transactions, transparent exchange rates, fast verification, and reliable support.

Search engines like Google also prioritize platforms that are secure, fast, and user-friendly. This is why choosing a future-ready exchanger software is critical for ranking, conversion, and customer retention. RoboExchanger.com has emerged as a powerful solution in this space by offering both automatic and semi-automatic exchange systems with multi-currency support. In this guide, we will explore how to choose the best money exchanger software in 2026 by analyzing real-world requirements, essential features, automation capabilities, security standards, SEO compatibility, and long-term business growth factors.

Whether you are launching a new exchange platform or upgrading an existing one, this detailed guide will help you make an informed, buymoney exchanger software confident decision that aligns with both user expectations and search engine standards.

Understanding Money Exchanger Software

Money exchanger software is a specialized web-based system designed to facilitate currency exchange between multiple digital and fiat payment methods through a secure and automated platform. In 2026, this software has evolved far beyond simple rate conversion tools. Modern exchanger scripts now integrate APIs, wallets, payment gateways, compliance tools, and automation engines to deliver real-time exchange services.

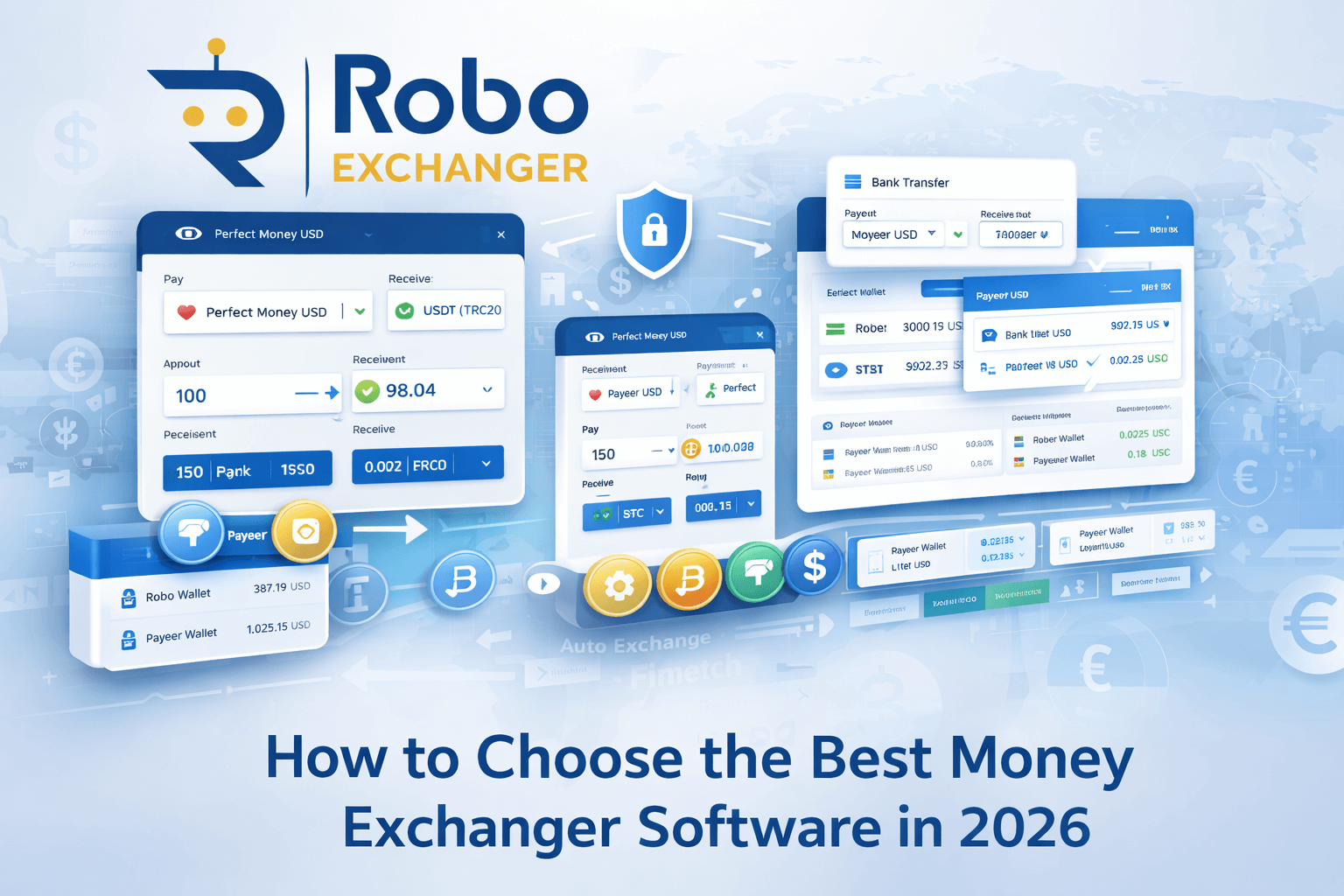

The best money exchanger software allows users to exchange currencies such as Perfect Money, Payeer, USDT, Bitcoin, Litecoin, Skrill, Neteller, and bank payments with minimal effort. Automation plays a major role in reducing manual workload and transaction delays. Fully automatic systems process exchanges instantly using API connections, while semi-automatic systems give administrators manual control where needed.

Understanding this difference is crucial before choosing a platform. Many businesses fail because they select software that does not match their operational capacity or compliance requirements. A reliable exchanger script must support dynamic rate management, commission control, transaction tracking, and dispute handling. Additionally, it should be scalable, meaning it can handle increased traffic and transaction volume without performance issues.

RoboExchanger software is designed with these modern needs in mind, providing flexibility for both beginners and established exchange operators. In 2026, regulatory awareness and user trust are equally important. Money exchanger software must support KYC options, fraud prevention, and admin moderation tools.

Search engines also value trust signals such as SSL security, buy money exchanger software fast page loading, and structured data. Therefore, understanding what money exchanger software truly is—and what it should offer—is the first step toward choosing the best solution for sustainable growth and top Google rankings.

Why Automation Matters in 2026

Automation is the backbone of successful money exchange platforms in 2026. Users now expect instant exchanges, real-time confirmations, and zero waiting time. A money exchanger software without automation will struggle to compete in this fast-paced digital environment. Fully automatic exchange systems use API connections with payment gateways and wallets to complete transactions instantly, reducing human error and operational delays.

Semi-automatic systems, on the other hand, allow administrators to manually verify or approve transactions when needed, offering flexibility for high-risk or high-value exchanges. Choosing the right balance between automation and control is essential. Automation directly impacts customer satisfaction, operational efficiency, and profitability. It also reduces staffing costs and minimizes disputes caused by delays.

RoboExchanger offers both automatic and semi-automatic exchange options, making it suitable for a wide range of business models. In 2026, automation also plays a role in SEO performance. Google favors websites that provide fast, reliable, and consistent user experiences. Automated systems reduce bounce rates, increase session duration, and improve overall engagement metrics. Additionally, automated rate updates ensure that users always see accurate pricing, which builds trust and credibility.

Security automation such as transaction monitoring, IP tracking, and fraud alerts further enhances platform reliability. When choosing the best money exchanger software, always evaluate how automation is implemented, how stable the APIs are, and whether manual override options are available. A future-proof exchanger script should grow with your business while maintaining speed, accuracy, and trust at every stage.

Multi-Currency Support and Flexibility

One of the most important factors when choosing the best money exchanger software in 2026 is multi-currency support. A successful exchange platform must cater to a global audience with diverse payment preferences. Limiting your platform to only a few currencies significantly reduces growth potential. Modern users expect support for popular digital wallets, cryptocurrencies, and fiat payment systems.

A professional exchanger script should allow administrators to add, remove, or modify currencies easily without complex coding. RoboExchanger excels in this area by offering extensive currency compatibility with both automatic and semi-automatic processing options. Flexibility is equally important. Exchange rates should be adjustable manually or automatically based on market conditions. Commission structures must be customizable for different currency pairs.

The software should also support minimum and maximum exchange limits to manage risk. In 2026, users value transparency, so displaying clear rates, fees, and processing times is essential. Multi-currency support also impacts SEO, as each currency pair can be optimized for targeted keywords and landing pages. This creates more indexing opportunities and organic traffic growth. Additionally, flexible currency management allows businesses to adapt quickly to market trends and user demand.

When evaluating buy money exchanger software, always check how easily currencies can be managed, how stable the integrations are, and whether future expansions are supported. A flexible multi-currency system is not just a feature—it is a long-term growth strategy.

Security and Trust Factors

Security is a non-negotiable element of money exchanger software in 2026. With increasing cyber threats and financial fraud, users are more cautious than ever. A single security breach can destroy trust and permanently damage a brand. The best money exchanger software must include multiple layers of protection, including SSL encryption, secure login systems, transaction verification, and admin access controls.

RoboExchanger is built with a strong security framework that protects both users and administrators. Features such as IP logging, email notifications, manual approval options, and transaction history tracking help prevent fraud and resolve disputes efficiently. Trust is not only about technical security but also about transparency and reliability. Users want clear communication, accurate processing, and responsive support.

Google also evaluates trust signals when ranking financial websites. Secure platforms with fast performance and low error rates are rewarded with better visibility. In 2026, compliance awareness is growing, so optional KYC and verification features add credibility. A secure exchanger script also protects your business from chargebacks, fake transactions, and system abuse.

When choosing money exchanger software, review how security updates are handled, whether the codebase is actively maintained, and how vulnerabilities are addressed. Investing in a secure platform is not an expense—it is a safeguard for your reputation, revenue, and long-term success.

Admin Control and Management Tools

Behind every successful money exchange platform is a powerful admin panel. In 2026, efficient management tools are essential for handling high transaction volumes and diverse currencies. The best money exchanger software should provide a clean, intuitive admin dashboard that allows full control over exchanges, users, rates, commissions, and system settings. RoboExchanger offers an advanced admin panel designed for both beginners and experienced operators.

Admins should be able to monitor transactions in real time, approve or reject exchanges, manage user accounts, and generate reports with ease. Automation settings should be configurable, allowing different processing rules for different currencies. A good admin panel also supports content management, SEO settings, and system notifications. This helps maintain platform quality and search engine visibility.

In 2026, data-driven decision-making is crucial. Detailed analytics and logs allow administrators to identify trends, detect issues, and optimize performance. Admin control is also closely tied to security, as restricted access levels prevent unauthorized actions. When evaluating money exchanger software, test the admin interface thoroughly. A powerful backend saves time, reduces errors, and supports scalable growth. Without proper admin tools, buy money exchanger software even the most feature-rich platform will struggle to operate efficiently.

User Experience and Interface Design

User experience plays a decisive role in the success of money exchanger software in 2026. Even the most secure and automated system will fail if users find it confusing or slow. A clean, responsive, and intuitive interface builds trust and encourages repeat usage. The best money exchanger software should guide users smoothly from currency selection to transaction completion.

RoboExchanger focuses on simplicity and clarity, ensuring that even first-time users can complete exchanges without assistance. Mobile responsiveness is no longer optional. A large portion of users access exchange platforms from smartphones, so the interface must adapt seamlessly to all devices. Page speed, form validation, and clear feedback messages significantly impact user satisfaction.

From an SEO perspective, good user experience reduces bounce rates and improves engagement metrics, which are key ranking factors. Accessibility is another important consideration in 2026. Clear typography, readable layouts, and logical navigation improve usability for all users. When choosing money exchanger software, always evaluate the frontend design, loading speed, and ease of use. A user-friendly platform not only converts better but also builds long-term trust and brand loyalty.

SEO and Google Ranking Compatibility

In 2026, SEO compatibility is a critical factor when choosing the best money exchanger software. A platform that is not optimized for search engines will struggle to gain organic visibility, regardless of its features. The software should support clean URLs, meta tags, schema markup, and fast loading speeds. RoboExchanger is designed with SEO-friendly architecture, allowing businesses to optimize pages for targeted keywords such as money exchanger software, online exchange script, and automatic currency exchange.

Content flexibility is important, as it allows site owners to publish blogs, FAQs, buy money exchanger software and landing pages that attract organic traffic. Technical SEO factors such as mobile friendliness, HTTPS security, and structured navigation also influence rankings. Google prioritizes financial websites that demonstrate expertise, authority, and trustworthiness. A well-built exchanger platform supports these signals through stability, transparency, and performance.

In 2026, user behavior metrics such as time on site and conversion rates further impact rankings. Choosing SEO-ready money exchanger software gives your business a competitive advantage by combining technical strength with marketing potential. Always consider SEO features during software evaluation, not as an afterthought.

Integration with Payment Gateways and APIs in 2026

In 2026, seamless integration with payment gateways and APIs is one of the most decisive factors when choosing the best money exchanger software. Modern users expect instant connectivity between different digital wallets, cryptocurrencies, and fiat payment systems without delays or manual intervention. A professional money exchanger script must support stable API connections that ensure accurate balance updates, real-time transaction confirmations, and uninterrupted exchange flows.

Poor API integration often leads to failed transactions, delayed processing, and loss of user trust. RoboExchanger is designed to work smoothly with a wide range of payment gateways, making both automatic and semi-automatic exchanges reliable and efficient. API stability is especially important as transaction volumes grow. A strong exchanger software should handle concurrent exchanges without crashing or slowing down.

In 2026, platform downtime directly affects SEO rankings and business credibility. Search engines favor websites that provide consistent availability and fast responses. Additionally, flexible API integration allows businesses to add new payment methods as market demand changes. This adaptability gives exchange platforms a competitive edge and long-term relevance. Another important aspect is error handling and fallback options.

A well-built exchanger script ensures that if an API fails temporarily, transactions are paused safely instead of being lost. When selecting money exchanger software, always examine how payment gateways are integrated, how frequently APIs are updated, and whether the system supports both automated processing and manual verification. Strong gateway integration is not just a technical feature; it is the foundation of trust, speed, and scalability in modern online money exchange platforms.

Compliance Readiness and Risk Management Capabilities

As financial regulations continue to evolve in 2026, compliance readiness has become a crucial consideration for money exchanger software. Governments and financial authorities across the world are enforcing stricter rules to prevent money laundering, fraud, and illegal financial activities. While not all exchange platforms are required to follow the same regulations, having compliance-friendly features increases trust and business longevity.

The best money exchanger software provides optional verification tools, transaction monitoring, and admin-level risk controls that allow operators to adapt to regulatory expectations. RoboExchanger offers flexible control over transaction approval, making it suitable for both low-risk and high-risk exchange environments. Risk management is equally important for protecting business assets.

A reliable exchanger script allows administrators to set exchange limits, control suspicious activity, and manually review high-value transactions. In 2026, automated fraud detection combined with human oversight provides the most effective defense against system abuse. Compliance-friendly platforms also build stronger relationships with payment providers and partners, reducing the risk of account suspensions.

From an SEO perspective, compliant and transparent platforms gain higher trust signals, which positively influence rankings. Users are more likely to stay, transact, and return to platforms that feel safe and legitimate. When choosing money exchanger software, consider how well it supports compliance needs without overcomplicating operations. A balanced approach to regulation and usability ensures sustainable growth in a competitive digital finance market.

Customization and Branding Flexibility for Exchange Businesses

Customization and branding flexibility play a vital role in differentiating money exchange platforms in 2026. With many exchanger websites offering similar services, branding becomes the key factor that builds recognition and user loyalty. The best money exchanger software should allow full customization of design elements, logos, color schemes, and content without requiring deep technical knowledge.

RoboExchanger provides a flexible framework that allows businesses to create a unique brand identity while maintaining system stability. Customization also extends beyond visuals. Exchange rules, commission models, user workflows, and notification systems should be adjustable to match specific business strategies. In 2026, users value personalized experiences, and platforms that reflect professionalism and consistency are more likely to convert visitors into customers.

Branding flexibility also impacts SEO performance. A well-branded platform with original content, consistent structure, and clear messaging performs better in search results than generic-looking sites. Custom landing pages for different currency pairs and services increase keyword coverage and organic traffic. Additionally, buy money exchanger software customization allows businesses to adapt to regional markets and user preferences.

When choosing money exchanger software, avoid rigid systems that limit creativity and growth. A customizable platform supports innovation, strengthens brand authority, and ensures long-term competitiveness in the evolving digital exchange industry.

Customer Support, Maintenance, and Software Longevity

Customer support and ongoing maintenance are often overlooked but critically important factors when selecting money exchanger software in 2026. Even the most advanced exchanger script requires regular updates, security patches, and technical support to remain effective. A reliable software provider ensures that issues are resolved quickly and that the system stays compatible with changing technologies and payment gateways.

RoboExchanger emphasizes long-term usability by offering structured support and update-ready architecture. In 2026, software longevity directly affects return on investment. Platforms that are abandoned or poorly maintained quickly lose security, performance, and search engine visibility. Customer support is not just about fixing problems; it also helps businesses optimize their operations and adopt new features.

Responsive support builds confidence, especially for new exchange operators. From a user perspective, well-maintained platforms provide smoother experiences, fewer errors, and consistent service quality. Search engines also favor actively maintained websites, as they tend to be more secure and reliable.

When choosing money exchanger software, consider the provider’s update history, support responsiveness, and commitment to long-term development. A platform that evolves with industry trends ensures that your exchange business remains competitive, trusted, and profitable well into the future.

Scalability and Long-Term Growth

Scalability determines whether your money exchange business can grow sustainably in 2026 and beyond. The best money exchanger software should be able to handle increasing traffic, transactions, and currency additions without performance degradation. RoboExchanger is built with scalability in mind, allowing businesses to expand gradually without rebuilding the platform.

Cloud compatibility, optimized database structure, and modular features support long-term growth. Scalability also includes business flexibility. As regulations, user preferences, and market conditions change, the software should adapt easily. Regular updates, feature enhancements, and technical support are indicators of a scalable solution.

In 2026, competition is intense, and only platforms that evolve will survive. Choosing scalable money exchanger software ensures that your investment remains valuable over time. It also improves investor confidence and user trust. When evaluating options, think beyond current needs and plan for future expansion. A scalable platform supports innovation, resilience, and sustained profitability.

Conclusion

Choosing the best money exchanger software in 2026 requires a holistic approach that balances automation, security, flexibility, user experience, SEO, and scalability. The digital finance landscape is evolving rapidly, and businesses must adopt solutions that are reliable, future-ready, and user-centric. RoboExchanger.com stands out as a comprehensive money exchanger script that supports both automatic and semi-automatic exchanges, multi-currency management, strong security, and SEO-friendly architecture.

By focusing on automation efficiency, admin control, and user trust, it addresses the real challenges faced by modern exchange platforms. In 2026, success is not just about launching a website—it is about building a sustainable financial ecosystem that users trust and search engines reward.

Investing in the right money exchanger software sets the foundation for long-term growth, visibility, and profitability. Make informed decisions, prioritize quality, and choose a platform that evolves with your business goals. The right software today will define your success tomorrow.