- The Evolution of the Money Exchanger Script Industry

- Why RoboExchanger Is the Complete Next-Generation Money Exchanger Script Solution

- 1. Advanced Multi-Layer Security Architecture with AI Fraud Detection

- 2. Real-Time Automatic & Smart Semi-Automatic Exchange Engine

- 3. Multi-Currency, Crypto & Stablecoin Expansion with Global API Integration

- 4. Ultra-Modern UX/UI with Conversion-Focused Design

- 5. Built-In Compliance, KYC Automation & Regulatory Readiness

- 6. Advanced Analytics, AI Insights & Revenue Optimization Tools

- 7. Cloud-Native Scalability & High-Performance Infrastructure

- 8. Smart Liquidity Management & Automated Reserve Monitoring

- 9. Mobile-First Optimization & Progressive Web App Integration

- 10. Smart Marketing Automation & Customer Retention Systems

The Evolution of the Money Exchanger Script Industry

The digital finance industry is evolving at an unprecedented pace, and in 2026, businesses operating in online currency exchange must adopt smarter, faster, and more secure systems to stay competitive. A modern Money Exchanger Script is no longer just a simple rate calculator with deposit and withdrawal functions. Today’s users expect automation, seamless performance, airtight security, and real-time processing across multiple currencies including fiat and crypto. Platforms like RoboExchanger.com are already leading this transformation by offering automatic and semi-automatic exchange solutions that simplify global transactions. However, as competition grows and regulatory frameworks tighten, upgrading your exchange software becomes essential rather than optional.

In this comprehensive guide, we will explore the six next-generation upgrades every Money Exchanger Script needs in 2026 to remain profitable, scalable, and trustworthy. These upgrades are based on real industry demand, technological advancements, user behavior trends, and fintech innovation. Whether you are launching a new exchange platform or upgrading your existing system, understanding these improvements will help you dominate the market and improve user retention.

From AI-driven fraud detection to multi-layer security architecture and lightning-fast API integrations, each upgrade discussed here plays a vital role in long-term sustainability. If your goal is to rank higher on Google, attract more global customers, and maximize revenue, then implementing these next-gen features in your Money Exchanger Script is the smartest move you can make this year.

Why RoboExchanger Is the Complete Next-Generation Money Exchanger Script Solution

When discussing the future of digital currency platforms in 2026, RoboExchanger.com stands out as a powerful, scalable, and innovation-driven Money Exchanger Script designed to meet modern financial demands. Unlike ordinary exchange software, RoboExchanger combines automatic and semi-automatic exchange capabilities within a secure, performance-optimized infrastructure. This hybrid model allows businesses to process instant transactions while maintaining administrative control over sensitive payment methods. Built with advanced multi-layer security architecture, real-time rate synchronization, and flexible currency management, RoboExchanger empowers entrepreneurs to launch a fully functional exchange platform without complex development challenges.

One of the strongest advantages of RoboExchanger is its adaptability. The system supports multiple currencies, crypto integrations, customizable exchange rates, automated fee calculation, and seamless API connectivity with global payment gateways. Its clean, modern user interface ensures a smooth customer journey, increasing transaction completion rates and improving overall user satisfaction. For administrators, the intelligent dashboard provides complete oversight of transactions, reserves, user activity, and revenue analytics, enabling data-driven decision-making.

In a competitive fintech landscape, reliability and trust define success. RoboExchanger is designed to deliver consistent uptime, fast processing speed, and regulatory-friendly features that prepare businesses for long-term growth. Whether you are targeting local markets or building a global currency exchange brand, this Money Exchanger Script offers the technical strength, flexibility, and scalability required to dominate the industry. Investing in RoboExchanger in 2026 means choosing innovation, automation, and profitability in one comprehensive solution.

1. Advanced Multi-Layer Security Architecture with AI Fraud Detection

Security remains the foundation of any successful Money Exchanger Script. In 2026, cyber threats are more sophisticated than ever, targeting financial platforms with phishing attacks, automated bot intrusions, and advanced malware. A next-generation money exchange platform must include a powerful multi-layer security architecture that goes beyond basic SSL encryption and two-factor authentication. Modern exchange software should implement firewall protection, DDoS mitigation, behavioral analysis systems, IP intelligence monitoring, and encrypted transaction processing to ensure complete data safety.

Artificial Intelligence-driven fraud detection is now a mandatory upgrade rather than a luxury. AI algorithms can analyze user patterns, transaction frequency, geolocation behavior, and device fingerprints to instantly detect suspicious activity. Unlike traditional security methods that rely on predefined rules, AI systems learn and adapt over time, reducing false positives while identifying real threats faster. This ensures a smoother user experience without unnecessary account suspensions.

RoboExchanger’s automatic and semi-automatic exchange model benefits greatly from enhanced security layers because automation increases transaction speed, and higher speed requires stronger protection. Secure admin dashboards, role-based access control, encrypted database storage, and activity log monitoring further strengthen platform integrity.

In 2026, customers prioritize safety above all else when choosing an exchange service. A secure Money Exchanger Script builds trust, increases repeat transactions, and improves brand reputation. Implementing AI-powered security upgrades is one of the most impactful investments for long-term business growth in the digital exchange industry.

2. Real-Time Automatic & Smart Semi-Automatic Exchange Engine

The core strength of any Money Exchanger Script lies in its exchange engine. In 2026, speed and accuracy define success. A next-generation script must offer a real-time automatic exchange system integrated with multiple payment gateways, crypto nodes, and API providers. Users expect instant conversions without delays, manual approval bottlenecks, or rate mismatches. A high-performance engine ensures live rate synchronization, accurate calculation of exchange fees, and instant balance updates.

However, fully automatic systems alone are not always sufficient. That is why a smart semi-automatic system remains crucial for certain payment methods requiring manual verification. The future upgrade involves intelligent hybrid automation where the system automatically verifies low-risk transactions while flagging higher-risk ones for admin review. This balance improves security while maintaining speed.

A modern exchange engine should also support liquidity management features, automated reserve monitoring, and intelligent rate margin adjustment to prevent loss during market volatility. With global currencies fluctuating constantly, dynamic pricing ensures profitability without compromising competitiveness.

Platforms like RoboExchanger already combine automatic and semi-automatic exchange models, making them adaptable for diverse markets. In 2026, integrating blockchain-based confirmation tracking, smart queue management, and API-based reserve updates will further enhance efficiency.

Ultimately, a fast and reliable exchange engine improves customer satisfaction, reduces support requests, and increases transaction frequency. Investing in a real-time hybrid automation upgrade ensures your Money Exchanger Script remains future-proof and revenue-driven.

3. Multi-Currency, Crypto & Stablecoin Expansion with Global API Integration

The financial landscape in 2026 is no longer limited to traditional fiat currencies. Customers demand access to cryptocurrencies, stablecoins, digital wallets, and cross-border payment methods. A next-generation Money Exchanger Script must support a broad range of currencies including USD, EUR, GBP, BTC, ETH, USDT, USDC, and emerging digital assets. Expanding currency coverage directly increases customer acquisition opportunities across global markets.

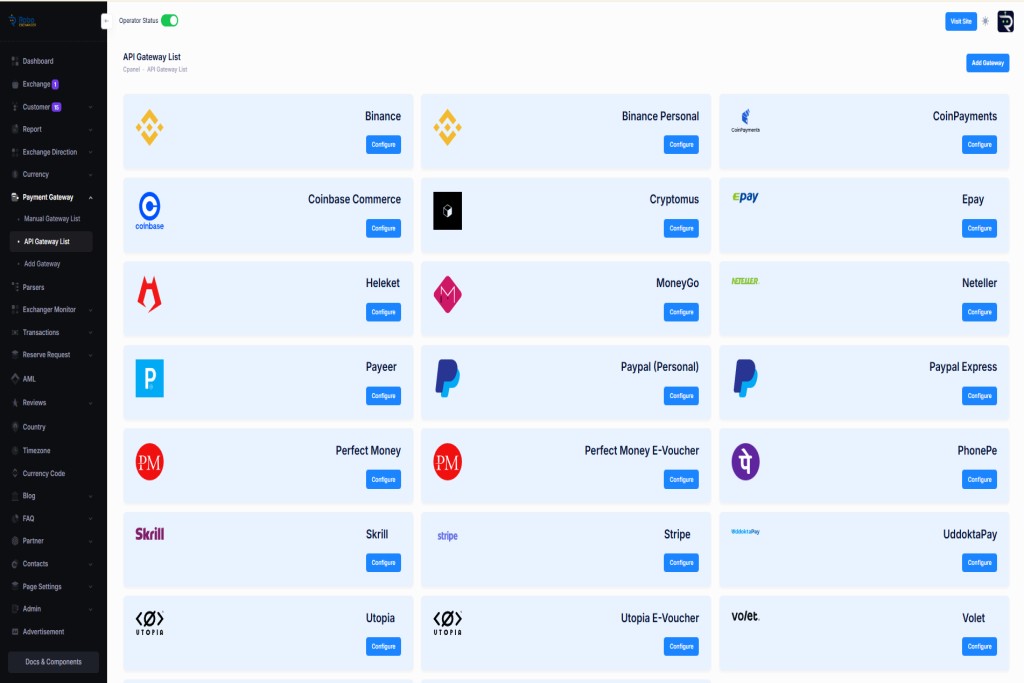

Beyond simply listing currencies, seamless API integration is essential. Payment gateway APIs, crypto wallet APIs, banking APIs, and third-party rate providers must synchronize in real time to avoid discrepancies. Advanced API management ensures uninterrupted connectivity, automated updates, and failover systems in case one provider experiences downtime.

Stablecoins are particularly important in 2026 because they offer reduced volatility compared to traditional cryptocurrencies. Integrating stablecoin exchange capabilities allows businesses to attract users seeking predictable digital transactions. Additionally, supporting regional payment processors expands accessibility in developing markets where global gateways may not operate efficiently.

RoboExchanger’s scalable framework can be enhanced by integrating multi-chain wallet support, automated node monitoring, and cross-network exchange compatibility. These upgrades allow users to exchange assets across different blockchain ecosystems smoothly.

Expanding into multi-currency and crypto markets strengthens your Money Exchanger Script’s SEO authority as well, since search demand continues growing worldwide. A globally integrated exchange system increases liquidity, revenue potential, and brand recognition in the highly competitive fintech ecosystem.

4. Ultra-Modern UX/UI with Conversion-Focused Design

User experience directly impacts transaction frequency. In 2026, a Money Exchanger Script must feature a clean, intuitive, and mobile-optimized interface that prioritizes simplicity. Users should complete exchanges in just a few clicks without confusion. A clutter-free dashboard, clear rate display, and transparent fee structure build trust and reduce abandonment rates.

Modern fintech design trends emphasize soft gradients, minimalist layouts, real-time notifications, and responsive mobile interfaces. Since most users access exchange platforms via smartphones, responsive design is non-negotiable. A next-gen UX upgrade includes progress indicators during transactions, instant confirmation popups, and visually clear status tracking.

Conversion-focused design also includes psychological triggers such as trust badges, live transaction counters, and real-time activity feeds. These elements subtly encourage users to complete transactions quickly. A seamless onboarding process with automated KYC upload options further improves first-time user experience.

RoboExchanger can benefit from integrating interactive dashboards, detailed transaction history analytics, and user-friendly admin panels. Reducing friction in the exchange journey directly increases revenue.

Search engines also favor user-friendly platforms because improved engagement metrics such as longer session duration and lower bounce rate positively impact rankings. Therefore, upgrading the UX/UI of your Money Exchanger Script not only improves usability but also strengthens your SEO performance and overall brand credibility in 2026.

5. Built-In Compliance, KYC Automation & Regulatory Readiness

Regulation in the digital finance industry is tightening worldwide. A next-generation Money Exchanger Script must include built-in compliance features to operate legally and securely. Automated KYC verification, AML monitoring, transaction reporting tools, and risk scoring systems are essential upgrades in 2026.

Manual compliance processes slow down operations and increase administrative costs. Automated document verification using AI-based OCR technology can instantly validate identity documents, reducing onboarding time. Integration with third-party compliance APIs further enhances credibility and reduces legal risk.

Transaction monitoring systems should generate real-time alerts for suspicious behavior while maintaining detailed logs for auditing purposes. Regulatory readiness ensures long-term sustainability and prevents sudden platform shutdowns due to non-compliance.

For platforms like RoboExchanger that offer automatic and semi-automatic exchange services, compliance automation strengthens trust among international clients. Businesses prefer working with exchange platforms that demonstrate transparency and legal responsibility.

Google also prioritizes trustworthy financial websites under its E-E-A-T guidelines. Implementing compliance upgrades improves credibility signals, helping your Money Exchanger Script rank higher in search results.

By investing in compliance-focused technology today, exchange businesses can avoid costly legal complications tomorrow while expanding confidently into global markets.

6. Advanced Analytics, AI Insights & Revenue Optimization Tools

The final essential upgrade for 2026 is intelligent analytics. A next-gen Money Exchanger Script must provide detailed reporting dashboards, revenue tracking, transaction heatmaps, and predictive insights powered by Artificial Intelligence.

Analytics help administrators understand user behavior, peak transaction hours, high-performing currencies, and profit margins. With AI-powered forecasting, businesses can anticipate demand fluctuations and adjust rates dynamically to maximize revenue.

Advanced reporting tools also enable automated financial summaries, exportable transaction reports, and real-time performance metrics. These insights empower business owners to make data-driven decisions rather than relying on guesswork.

AI can also suggest promotional campaigns, loyalty rewards, or fee adjustments based on user behavior trends. Personalized offers increase user retention and lifetime value.

RoboExchanger’s robust infrastructure can integrate these smart analytics features to provide full transparency and growth-focused insights. In 2026, data-driven exchange platforms outperform competitors significantly.

Combining automation, security, compliance, and analytics creates a powerful ecosystem that ensures scalability and long-term profitability. A Money Exchanger Script equipped with intelligent optimization tools becomes more than just software—it becomes a strategic fintech asset capable of dominating the digital currency market.

7. Cloud-Native Scalability & High-Performance Infrastructure

In 2026, a high-performing Money Exchanger Script must be built on a cloud-native infrastructure that guarantees scalability, reliability, and uninterrupted service availability. As transaction volumes increase and global users access the platform simultaneously, traditional shared hosting environments become insufficient. A next-generation exchange system should operate on scalable cloud servers with load balancing, auto-scaling resources, and distributed database architecture. This ensures that even during peak transaction periods, the platform remains fast and stable without downtime. Speed is a crucial ranking and conversion factor, especially for financial platforms where users expect instant confirmations and smooth processing. A delay of even a few seconds can reduce trust and cause abandoned transactions.

Cloud-native deployment also enables automated backups, disaster recovery systems, and real-time monitoring of server performance. With intelligent infrastructure monitoring, administrators can detect unusual spikes, optimize server allocation, and prevent outages before they occur. For platforms like RoboExchanger.com, which support automatic and semi-automatic exchanges, high-performance hosting ensures seamless API communication with payment gateways and crypto networks. Additionally, containerized deployment methods such as Docker and microservices architecture allow faster updates without interrupting live transactions.

Search engines prioritize fast-loading websites, meaning a high-performance infrastructure directly improves SEO rankings. A scalable cloud-based Money Exchanger Script not only handles growth efficiently but also positions your business for long-term expansion into international markets. Investing in strong infrastructure today guarantees stability, profitability, and user confidence in the competitive fintech ecosystem of 2026.

8. Smart Liquidity Management & Automated Reserve Monitoring

Liquidity management has become one of the most critical success factors for any modern Money Exchanger Script in 2026. Without proper reserve management, even a well-designed exchange platform can experience transaction delays, failed conversions, or financial losses during market volatility. A next-generation upgrade must include smart liquidity tracking that monitors currency reserves in real time across all integrated wallets, bank accounts, and crypto nodes. Automated alerts should notify administrators when reserves fall below predefined thresholds, allowing quick adjustments before users experience service interruptions.

Advanced reserve monitoring systems also integrate predictive analytics to forecast demand spikes based on historical transaction data. This ensures that the platform maintains sufficient liquidity for high-demand currencies, especially during market trends or global economic events. Automated balancing features can redistribute funds between wallets or payment gateways to maintain smooth operations. For RoboExchanger.com, which supports both automatic and semi-automatic exchange models, intelligent liquidity management prevents bottlenecks and maintains instant transaction capability.

Furthermore, integrating dynamic rate margin adjustments based on liquidity levels helps protect profitability. If reserves decrease for a specific currency, the system can automatically adjust the exchange margin slightly to stabilize flow without disrupting user experience. A well-managed liquidity system builds reliability, increases user trust, and reduces manual administrative work. In 2026, exchange platforms that implement automated reserve intelligence gain a significant competitive advantage, ensuring consistent service quality and sustainable financial growth.

9. Mobile-First Optimization & Progressive Web App Integration

The dominance of mobile users in digital finance cannot be ignored in 2026. A modern Money Exchanger Script must adopt a mobile-first development strategy to deliver a seamless experience across smartphones and tablets. Most users now prefer completing financial transactions through mobile devices, making responsive design and performance optimization essential. A next-generation exchange platform should load quickly on mobile networks, display real-time rate updates clearly, and allow instant deposits and withdrawals without unnecessary page reloads.

Progressive Web App integration is a powerful upgrade that transforms a standard exchange website into an app-like experience without requiring users to download from app stores. With PWA functionality, users can receive push notifications for transaction updates, rate alerts, and promotional offers directly on their devices. Offline caching features also ensure that core elements load instantly, even with unstable internet connections. For RoboExchanger.com, integrating a mobile-optimized interface enhances user retention and increases transaction frequency, especially in regions where mobile usage dominates desktop access.

Mobile optimization also contributes significantly to search engine rankings, as Google prioritizes mobile-friendly websites in its indexing algorithm. Faster loading speeds, optimized images, and simplified navigation improve engagement metrics such as session duration and bounce rate. In 2026, a Money Exchanger Script without strong mobile optimization risks losing both traffic and credibility. Adopting a mobile-first and PWA-enabled framework ensures higher conversions, improved brand perception, and sustainable growth in the evolving fintech market.

10. Smart Marketing Automation & Customer Retention Systems

Beyond technical upgrades, a successful Money Exchanger Script in 2026 must include built-in marketing automation and customer retention tools. Acquiring new users is important, but retaining existing customers generates long-term profitability and stable revenue growth. A next-generation exchange system should integrate automated email campaigns, SMS alerts, loyalty rewards, referral programs, and personalized promotional offers based on transaction behavior. These features encourage repeat usage and strengthen customer relationships.

Artificial Intelligence can analyze user activity patterns to identify inactive accounts or declining transaction frequency. The system can automatically trigger targeted incentives such as discounted exchange fees or bonus credits to re-engage those users. Real-time notifications about favorable exchange rates also motivate users to complete transactions promptly. For RoboExchanger.com, implementing intelligent retention strategies enhances brand loyalty and increases lifetime customer value.

Integrated affiliate management systems further expand marketing reach by rewarding partners who bring new customers. Automated commission tracking and performance analytics simplify affiliate operations and reduce manual workload. Additionally, Money Exchanger Script CRM integration ensures that support teams have access to detailed user histories, enabling faster and more personalized assistance.

Search engines recognize active, engaging platforms with consistent traffic growth, which indirectly benefits SEO performance. In 2026, a Money Exchanger Script that combines advanced marketing automation with secure and efficient exchange functionality becomes a powerful fintech ecosystem capable of dominating competitive global markets.