- The Evolution of Currency Exchange in the Digital Age

- Understanding Manual Currency Exchange Systems

- What Is Currency Exchange Software?

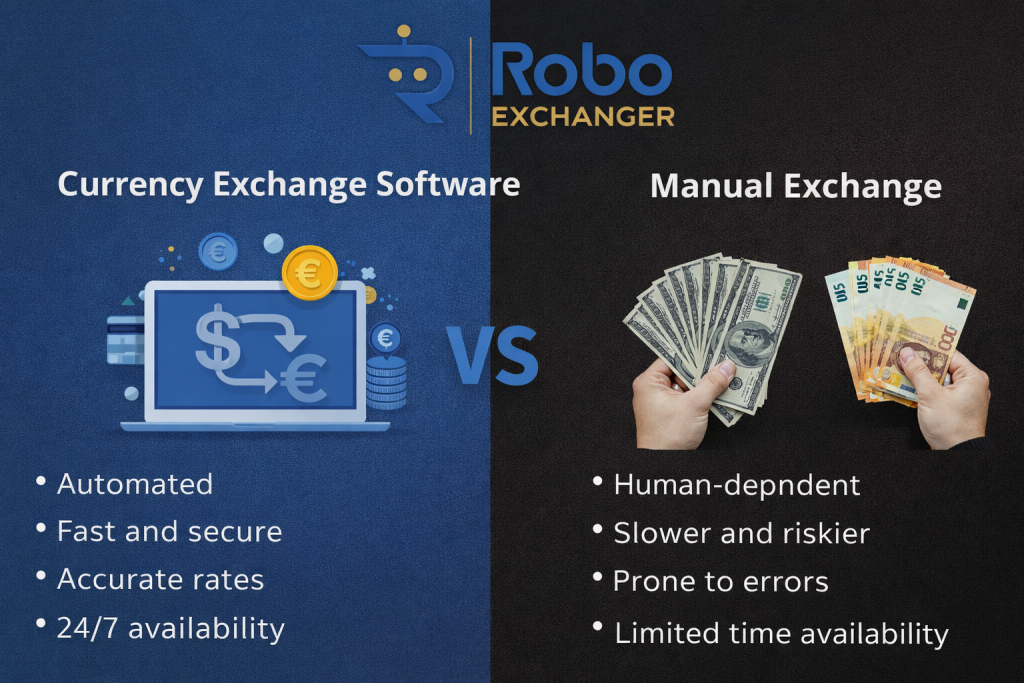

- Automation vs Human Dependency: A Core Difference

- Security and Accuracy: Software Takes the Lead

- Scalability and Business Growth Potential

- Customer Experience and Satisfaction

- Cost Efficiency and Long-Term Profitability

- Automatic and Semi-Automatic Exchange with RoboExchanger

- Regulatory Compliance and Transparency in Currency Exchange Operations

- Speed and Efficiency: Meeting Modern User Expectations

- Data Management and Business Intelligence Advantages

- Global Reach and Multi-Currency Capability

- Reduced Operational Stress and Human Error

- Future-Proofing Your Currency Exchange Business

- Trust Building and Brand Credibility in Digital Currency Exchange

- Integration Capabilities and Payment Gateway Flexibility

The Evolution of Currency Exchange in the Digital Age

The global currency exchange industry has transformed dramatically over the last decade, moving from traditional, counter-based manual systems to highly automated, software-driven platforms. As international trade, freelancing, digital payments, and cross-border businesses continue to grow, the demand for fast, secure, and reliable currency exchange solutions has never been higher. In the past, manual currency exchange dominated the market, relying heavily on human involvement, physical offices, and time-consuming verification processes. While this method worked for many years, it has become increasingly inefficient in today’s fast-paced digital economy.

Customers now expect instant processing, real-time exchange rates, and seamless transactions without unnecessary delays. This is where modern currency exchange software comes into play. Advanced platforms like RoboExchanger have redefined how money exchange businesses operate by offering fully automatic and semi-automatic currency exchange systems. These solutions integrate APIs, payment gateways, and security protocols to deliver unmatched efficiency and accuracy. When comparing currency exchange software with manual exchange methods, it becomes clear that technology offers scalability, speed, and transparency that manual systems struggle to match.

However, some business owners still prefer manual exchange due to perceived control and familiarity. In this in-depth comparison, we will explore both approaches in detail, analyzing their workflows, advantages, limitations, and long-term business impact. By the end of this article, you will have a clear understanding of which solution is better suited for modern currency exchange businesses and why exchange software vs manual exchange automated currency exchange software is rapidly becoming the industry standard worldwide.

Understanding Manual Currency Exchange Systems

Manual currency exchange systems are the traditional approach where transactions are processed by human operators without the assistance of automated software. In this model, exchange rates are often updated manually, transactions are verified by staff, and records are maintained through spreadsheets or basic accounting tools. While this method may appear simple on the surface, it involves multiple layers of complexity behind the scenes. Employees must constantly monitor market rates, calculate conversions accurately, communicate with customers, and ensure compliance with financial regulations.

Human error is a significant risk factor in manual exchange, especially when dealing with high transaction volumes or multiple currencies. Even a small miscalculation can result in financial loss or customer dissatisfaction. Additionally, manual systems are time-intensive, requiring staff availability during working hours only, which limits business scalability. Customers often experience delays in processing, confirmation, and fund delivery, reducing overall trust in the service.

Security is another major concern, as manual handling of sensitive financial data increases the risk of fraud, data leaks, or internal misconduct. Although some small exchange businesses still rely on manual processes due to lower initial costs, this approach becomes increasingly inefficient as transaction volume grows. In today’s competitive digital market, manual currency exchange struggles to meet customer expectations for speed, transparency, and convenience, making it less viable for long-term business growth.

What Is Currency Exchange Software?

Currency exchange software is a digital solution designed to automate and manage currency conversion, transactions, and customer interactions through a centralized platform. Modern solutions like RoboExchanger provide both automatic and semi-automatic exchange systems, allowing businesses to process transactions instantly or with minimal manual intervention. These platforms integrate real-time exchange rates, payment gateways, wallet systems, and advanced security features to ensure accuracy and reliability.

Currency exchange software eliminates repetitive manual tasks by automating calculations, confirmations, and record-keeping. This not only reduces operational costs but also minimizes the risk of human error. Customers benefit from faster processing times, transparent exchange rates, and 24/7 service availability. From an administrative perspective, exchange software offers detailed reporting, transaction logs, and analytics, enabling business owners to monitor performance and make data-driven decisions.

Additionally, many currency exchange scripts support multiple currencies, cryptocurrencies, and payment methods, making them highly versatile. As digital finance continues to expand globally, currency exchange software has become an essential tool for businesses aiming to stay competitive, compliant, and scalable in an increasingly automated financial ecosystem.

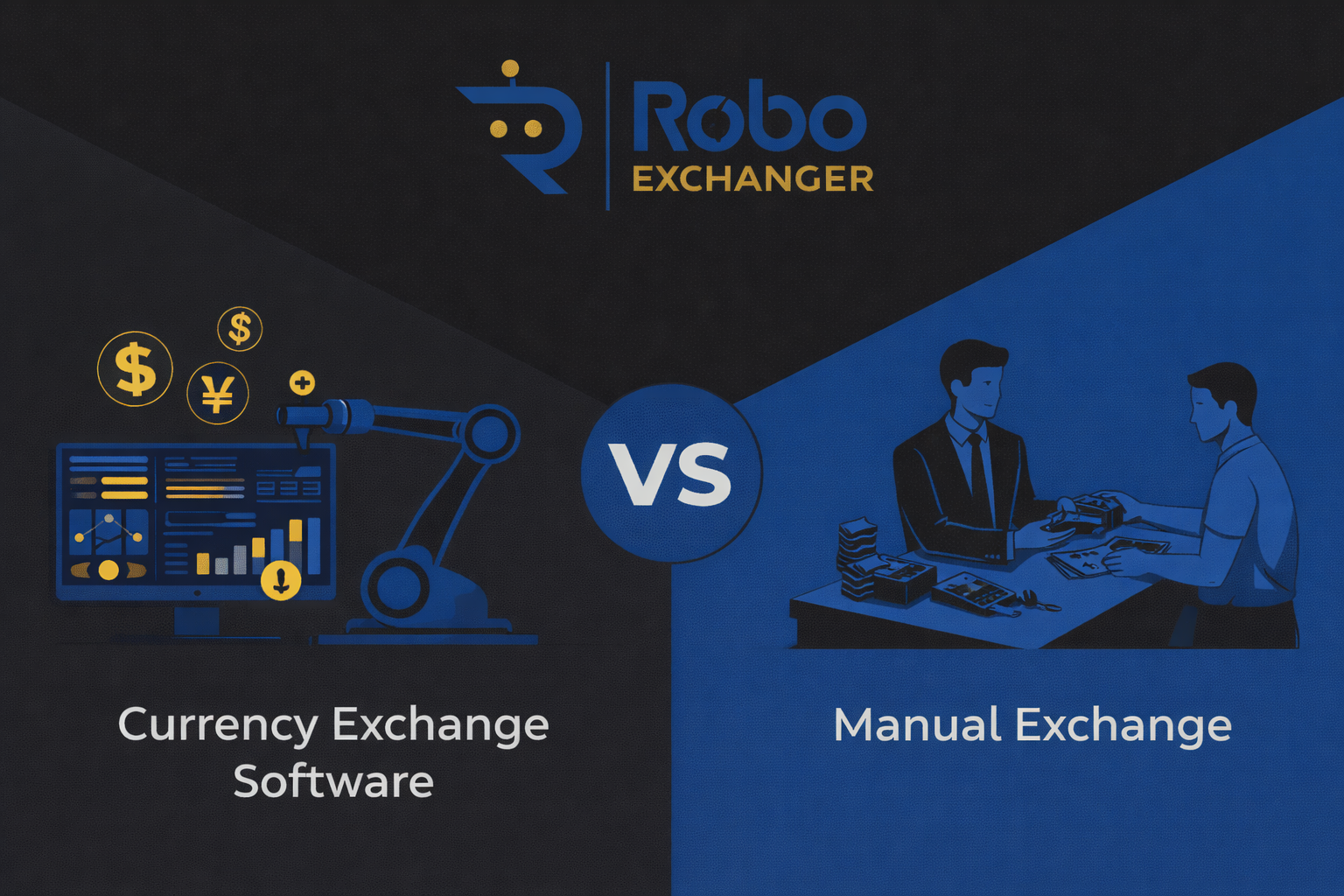

Automation vs Human Dependency: A Core Difference

One of the most significant differences between currency exchange software and manual exchange systems is the level of automation involved. Manual exchange relies heavily on human operators for every step of the process, from rate calculation to transaction confirmation. This dependency introduces delays, inconsistencies, and higher operational costs. In contrast, automated currency exchange software processes transactions instantly using predefined rules and real-time data.

Platforms like RoboExchanger allow businesses to automate rate updates, balance management, and transaction verification, significantly improving efficiency. Automation also ensures consistency, as the same logic is applied to every transaction without variation. Human involvement is limited to monitoring and customer support, freeing staff to focus on strategic tasks rather than repetitive work. This shift from human dependency to automation not only improves speed but also enhances reliability and customer satisfaction. In a market where trust and efficiency are critical, automation provides a clear competitive advantage over manual systems.

Security and Accuracy: Software Takes the Lead

Security is a top priority in the currency exchange business, and this is an area where software-based solutions clearly outperform manual systems. Manual exchange processes often involve physical documents, spreadsheets, and verbal confirmations, all of which are vulnerable to errors and fraud. Currency exchange software, on the other hand, uses encrypted transactions, secure APIs, and automated verification mechanisms to protect sensitive data. RoboExchanger, for example, offers advanced security features such as transaction logs, IP tracking, and system-level controls that significantly reduce risk.

Accuracy is another critical factor. Automated systems calculate exchange rates and transaction amounts with precision, eliminating human miscalculations. This ensures that both the business and the customer receive exactly what is expected, building long-term trust. In an industry where even small discrepancies can have serious financial implications, the superior security and accuracy of currency exchange software make it the safer and more reliable choice.

Scalability and Business Growth Potential

Scalability is a major limitation of manual currency exchange systems. As transaction volume increases, businesses must hire more staff, expand office space, and invest in additional resources. This approach is not only costly but also inefficient. Currency exchange software is designed to scale effortlessly, handling thousands of transactions simultaneously without compromising performance. With platforms like RoboExchanger, businesses can expand their services, add new currencies, and integrate additional payment gateways with minimal effort.

This scalability enables rapid business growth without a proportional increase in operational costs. For entrepreneurs and startups aiming to build a global exchange platform, software-based solutions provide the flexibility and scalability needed to succeed in a competitive market.

Customer Experience and Satisfaction

Customer experience plays a crucial role in the success of any currency exchange business. Manual exchange systems often result in long waiting times, limited availability, and inconsistent service quality. In contrast, currency exchange software offers a seamless and user-friendly experience. Customers can initiate exchanges, track transaction status, and receive confirmations in real time. Automated systems operate 24/7, allowing users to exchange currency at their convenience. Features like instant processing, transparent rates, and secure transactions significantly enhance customer satisfaction. A positive user experience not only increases customer retention but also encourages word-of-mouth referrals, contributing to organic business growth.

Cost Efficiency and Long-Term Profitability

While manual exchange systems may appear cheaper initially, their long-term costs are significantly higher. Salaries, training, errors, and inefficiencies add up over time. Currency exchange software requires an upfront investment but delivers substantial long-term savings through automation and reduced operational expenses. RoboExchanger, for example, provides a complete money exchanger script that eliminates the need for extensive manual labor. This cost efficiency translates into higher profit margins and faster return on investment. For businesses focused on sustainability and profitability, software-based exchange solutions offer a clear financial advantage.

Automatic and Semi-Automatic Exchange with RoboExchanger

RoboExchanger stands out in the market by offering both automatic and semi-automatic currency exchange systems. This flexibility allows businesses to choose the level of automation that best suits their operational needs. Automatic exchanges process transactions instantly without human intervention, while semi-automatic exchanges allow manual approval when required. This hybrid approach ensures maximum control without sacrificing efficiency.

RoboExchanger supports multiple currencies, payment gateways, and security features, making it an ideal solution for modern exchange businesses. Its user-friendly interface and robust backend make it suitable for both beginners and experienced operators.

Regulatory Compliance and Transparency in Currency Exchange Operations

Regulatory compliance is one of the most critical aspects of running a successful currency exchange business, and it is an area where currency exchange software significantly outperforms manual exchange systems. Manual operations often rely on human judgment to follow compliance rules, document transactions, and maintain records. This approach increases the risk of non-compliance due to oversight, inconsistency, or lack of proper documentation. As financial regulations continue to tighten globally, even small mistakes can result in penalties, legal complications, or loss of business credibility. Currency exchange software like RoboExchanger is designed with compliance and transparency in mind.

Every transaction is automatically logged, time-stamped, and stored securely, creating a clear audit trail that can be reviewed at any time. Exchange rates, transaction histories, and user activities are fully transparent, reducing disputes and increasing trust with customers and regulators alike. Automated systems ensure that predefined rules are followed consistently across all transactions, eliminating ambiguity and manual shortcuts. Transparency also improves customer confidence, as users can view real-time rates and transaction statuses without relying on verbal confirmations.

In a highly regulated financial environment, businesses that use modern exchange software are better positioned to adapt to regulatory changes quickly. Compliance becomes a built-in feature rather than an ongoing challenge, allowing business owners to focus on growth instead of paperwork and risk management.

Speed and Efficiency: Meeting Modern User Expectations

In today’s digital-first world, speed is no longer a luxury but a basic expectation. Manual currency exchange systems struggle to meet this demand because every step requires human involvement, from confirming payments to calculating rates and approving transactions. This creates unavoidable delays, especially during peak hours or when staff availability is limited. Currency exchange software solves this problem by automating the entire workflow. With platforms like RoboExchanger, exchange rates are updated in real time, transactions are processed instantly, and confirmations are generated automatically.

This level of efficiency allows businesses to handle a high volume of exchanges without compromising accuracy or service quality. Customers benefit from faster turnaround times, which directly improves satisfaction and trust. Speed also plays a crucial role in profitability, as quicker transactions allow businesses to process more exchanges within the same timeframe. In competitive markets, users are more likely to choose platforms that offer instant or near-instant service over slower manual alternatives.

Automated currency exchange software ensures that businesses remain relevant and competitive by aligning with modern user expectations. As digital transactions continue to dominate global finance, speed and efficiency will remain key differentiators, best money exchange software in 2026 for automatic online exchange businesses making software-based solutions the smarter long-term choice.

Data Management and Business Intelligence Advantages

Effective data management is essential for making informed business decisions, yet it is one of the weakest areas of manual currency exchange systems. Manual record-keeping often involves spreadsheets, paper logs, or disconnected tools that make it difficult to analyze performance accurately. Currency exchange software centralizes all transaction data into a single, structured system. RoboExchanger provides detailed reports, transaction histories, and performance metrics that help business owners understand trends, customer behavior, and revenue patterns. This data-driven approach enables smarter pricing strategies, better liquidity management, and improved customer targeting.

Automated reporting also saves time and reduces the risk of missing critical insights. With real-time dashboards and historical data access, exchange software vs manual exchange businesses can quickly identify issues and opportunities. Manual systems simply cannot match this level of visibility and control. In an increasingly competitive industry, access to accurate data is a major advantage. Currency exchange software transforms raw transaction data into actionable intelligence, empowering businesses to grow strategically rather than relying on guesswork.

Global Reach and Multi-Currency Capability

Manual currency exchange systems are often limited by geography, office hours, and available staff expertise. Expanding into new markets requires hiring trained personnel and managing additional operational complexity. Currency exchange software removes these barriers by enabling businesses to operate globally from a single platform. RoboExchanger supports multiple currencies and payment systems, allowing exchange businesses to serve international customers effortlessly.

Automated systems operate around the clock, making services accessible regardless of time zone differences. This global reach opens new revenue streams and allows businesses to scale beyond local markets. Customers from different regions can exchange currencies quickly and securely without physical interaction. Multi-currency support also reduces dependency on specific markets, helping businesses diversify and manage risk. In a globalized economy, the ability to serve international users is a major competitive advantage that manual exchange systems simply cannot provide.

Reduced Operational Stress and Human Error

Running a manual currency exchange business places significant pressure on staff, as even small mistakes can have serious financial consequences. Constant monitoring, repetitive calculations, and high transaction volumes increase stress and fatigue, leading to errors. Currency exchange software minimizes these risks by automating routine tasks and enforcing consistent rules. RoboExchanger reduces operational stress by handling calculations, confirmations, and record-keeping automatically. Staff can focus on customer support and strategic planning rather than repetitive work. This not only improves accuracy but also creates a healthier work environment. Reduced human error leads to fewer disputes, better financial control, and stronger customer trust. Over time, this operational stability becomes a key factor in long-term success.

Future-Proofing Your Currency Exchange Business

The financial industry is evolving rapidly, driven by digital payments, online businesses, and global connectivity. Manual currency exchange systems are increasingly outdated and struggle to adapt to new technologies and customer expectations. Currency exchange software offers a future-proof solution by providing flexibility, scalability, and continuous improvement opportunities. RoboExchanger is built to adapt, allowing businesses to integrate new payment methods, expand services, and update features as market demands change.

Investing in exchange software is not just about improving current operations but also about preparing for the future. Businesses that embrace automation today are better positioned to survive and thrive in tomorrow’s digital economy. In contrast, those who rely on manual processes risk falling behind competitors who can move faster, operate smarter, and serve customers better.

Trust Building and Brand Credibility in Digital Currency Exchange

Trust is the foundation of any financial service, and in the currency exchange industry, it plays an even more critical role. Manual exchange systems often depend on personal relationships, verbal assurances, and physical presence to establish trust. While this may work on a small scale, it becomes increasingly difficult to maintain credibility as the business grows or moves online. Currency exchange software offers a more reliable and transparent approach to trust building. Platforms like RoboExchanger provide users with clear transaction records, real-time exchange rates, and automated confirmations, all of which contribute to a sense of professionalism and reliability.

When customers can track their exchanges digitally and receive instant updates, they feel more secure and confident in the service. Consistency is another key factor in brand credibility. Automated systems ensure that every customer receives the same level of service regardless of time or transaction size. This uniform experience strengthens brand identity and reduces the likelihood of disputes. Over time, a trustworthy digital platform builds a strong reputation that attracts repeat customers and positive reviews.

In contrast, manual systems are more vulnerable to misunderstandings, delays, and inconsistent service, which can damage credibility. In the digital era, businesses that invest in professional currency exchange software are better positioned to build long-term trust and establish themselves as authoritative brands in the market.

Integration Capabilities and Payment Gateway Flexibility

Modern currency exchange businesses must operate within a complex digital ecosystem that includes payment gateways, wallets, APIs, and third-party services. Manual exchange systems struggle to integrate seamlessly with these tools, often requiring manual reconciliation and constant oversight. Currency exchange software is designed to solve this challenge by offering built-in integration capabilities. RoboExchanger supports multiple payment gateways and allows smooth connectivity with external financial services.

This flexibility enables businesses to offer customers a wide range of payment options, improving convenience and accessibility. Automated integrations also reduce processing time and eliminate errors associated with manual data entry. When payments, exchanges, and confirmations are synchronized automatically, the entire operation becomes more efficient and reliable. Integration capabilities also make it easier to adapt to market changes, such as adding new payment methods or supporting emerging digital currencies.

Businesses using manual systems often struggle to keep up with these developments, putting them at a competitive disadvantage. Currency exchange software provides the technical foundation needed to operate efficiently in a rapidly evolving digital landscape, making it an essential investment for forward-thinking exchange businesses.

Operational Consistency and Service Quality Assurance

Consistency in service quality is difficult to achieve with manual currency exchange systems due to variations in human performance. Different staff members may follow slightly different processes, leading to inconsistent customer experiences. Currency exchange software eliminates this issue by standardizing operations through automated workflows. RoboExchanger ensures that every transaction follows the same predefined rules, regardless of volume or timing. This consistency improves reliability and reduces customer complaints.

Automated systems also maintain service quality during peak periods when manual systems are most likely to fail due to overload. By removing variability from core processes, currency exchange software helps businesses maintain a high standard of service at all times. Customers appreciate predictable and dependable service, which encourages loyalty and long-term engagement. In competitive markets, consistent quality can be a key differentiator that sets a business apart from less reliable alternatives.

Competitive Advantage in a Technology-Driven Market

The currency exchange industry is becoming increasingly competitive as digital platforms lower entry barriers and expand global reach. Businesses that rely on manual exchange systems often struggle to compete with technologically advanced platforms that offer faster, safer, and more convenient services. Currency exchange software provides a significant competitive advantage by enabling automation, scalability, and innovation. RoboExchanger empowers businesses to deliver modern exchange services that meet current market expectations.

Features such as instant processing, multi-currency support, and secure transactions position software-based businesses as industry leaders. Customers are more likely to choose platforms that demonstrate technological competence and efficiency. In a technology-driven market, adopting advanced currency exchange software is not just about improving operations; it is about staying relevant and competitive. Businesses that fail to modernize risk losing market share to more agile and innovative competitors.

Final Verdict: Which Is Better?

When comparing currency exchange software with manual exchange systems, the answer is clear. Currency exchange software offers superior speed, accuracy, security, scalability, and customer experience. Manual exchange methods may still work for very small operations, but they are not sustainable in today’s digital economy. Platforms like RoboExchanger provide a future-proof solution that empowers businesses to grow, compete, and succeed globally. If your goal is long-term success, automation is not just an option—it is a necessity.